How might we simplify cash flow management for small business owners?

My Role

- Lead Product Designer

- UI Developer: built interactive web prototype for testing utilizing AngularJS

- Workshop Co-Facilitator

Work Type

- Agency work

Team Members

- Internal: Lane Goldstone (Engagement Lead / PM), Lara Fedoroff (Engagement Lead / PM)

- Kabbage external core: David Snitkof (Head of Data), Troy Deus (Head of Product), Laquisha Milner (PM), Casey Hobbs (Product), Adison Ragsdale (Mobile Lead), Michelle Monaco (Customer Loyalty & insights), Geof Alexander (Head of Product + Partner Delivery)

Introduction

Kabbage was created in 2011 and was one of the first companies to leverage technology to offer small businesses flexible lines of credit that they could get approved for in as little as 10 minutes.

Kabbage enlisted our help to diversify their product suite beyond just lending, seeking to identify other potential services that could be beneficial to their customers.

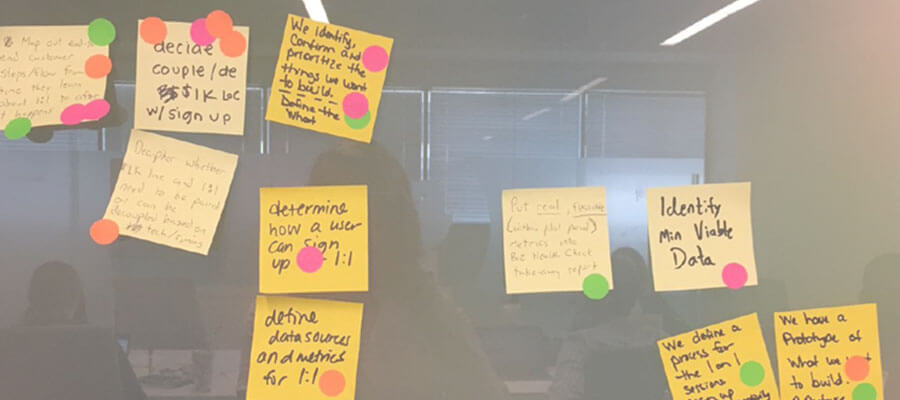

Sprint One: Foundations.

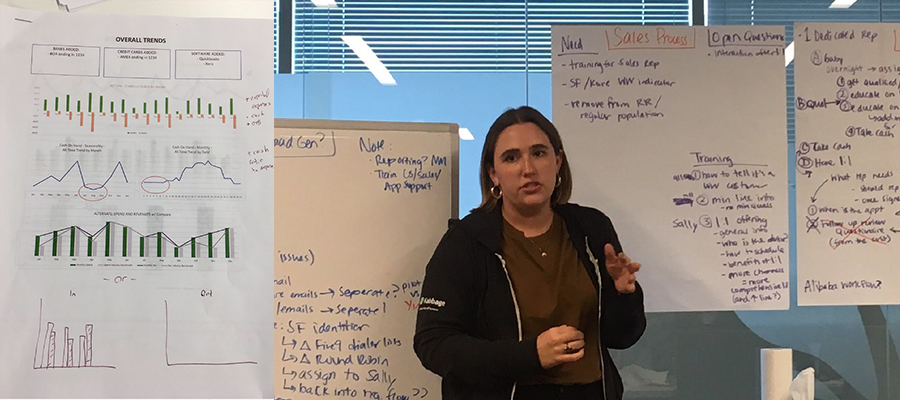

Facilitating company-wide ideation workshops

Internal Team Workshops

During the beginning of our engagement, my team and I guided Kabbage through various design thinking workshops. Core stakeholders included Kabbage’s CEO, CPO, and CTO. Together, we worked to clarify their goals with Cash Flow as a Service.

Sprint Two: Talking to SBO’s.

When we go out and talk to real people

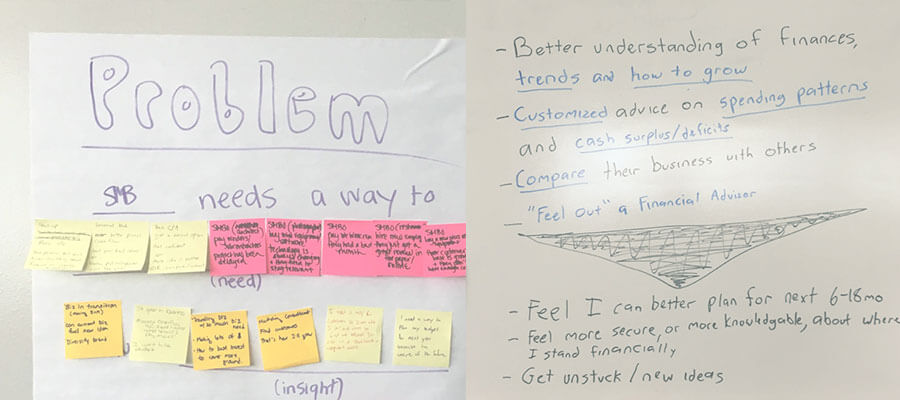

Finding patterns through user research (Jobs to be done)

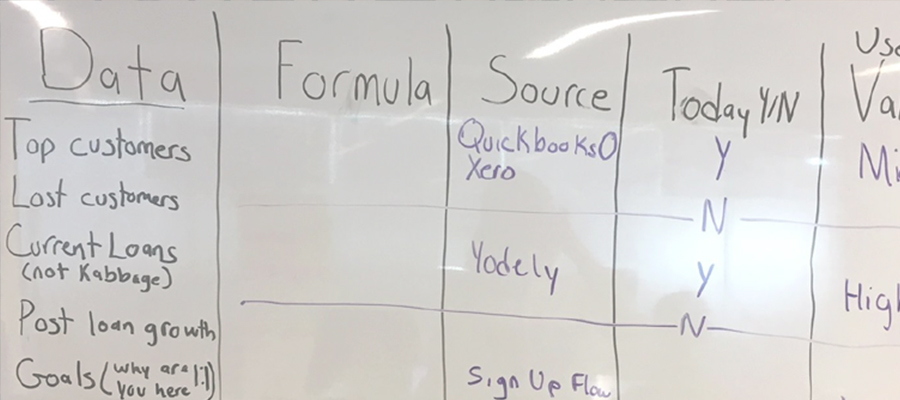

We conducted a round of research fieldwork with small business owners to develop a holistic understanding of how they handle their finances.

We listened for patterns of use to identify their challenges and understand how Kabbage could fit into their overall financial workflow.

We spoke to over 15 SBO’s,  gathering data on their cash flow patterns and pain points

gathering data on their cash flow patterns and pain points  to identify key attributes that drove behavior.

to identify key attributes that drove behavior.  From that, we developed attribute models

From that, we developed attribute models  of customer archetypes.

of customer archetypes.

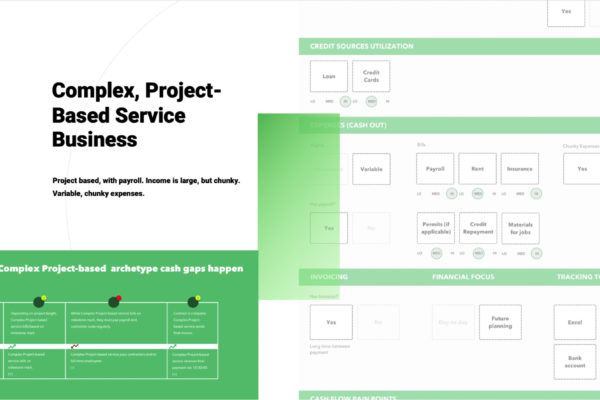

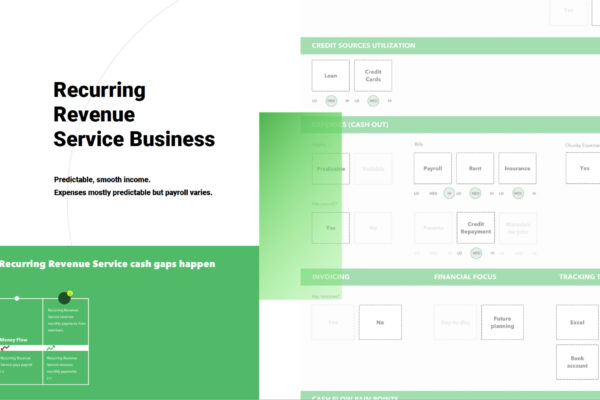

From our research, we identified four core types: 1) the simple solopreneur service business (I sell my time), 2) the complex, project-based service business (I assemble people and materials to do work), 3) the project-based installation service business (I buy stuff and install or improve it), and 4) the recurring revenue service business (I manage people or things to do work).

Research takeaways and patterns found.

We found that customers needed help with:

Covering chunky expenses

Trying to handle random, unexpected expenses is often a daunting experience for SBOs

Preparing for slow times

Unanticipated periods of business slowdown could kill a business

Seeing the big picture

SBOs longed for a birds-eye view of their cash flow, leaving more time for their true love – their business.

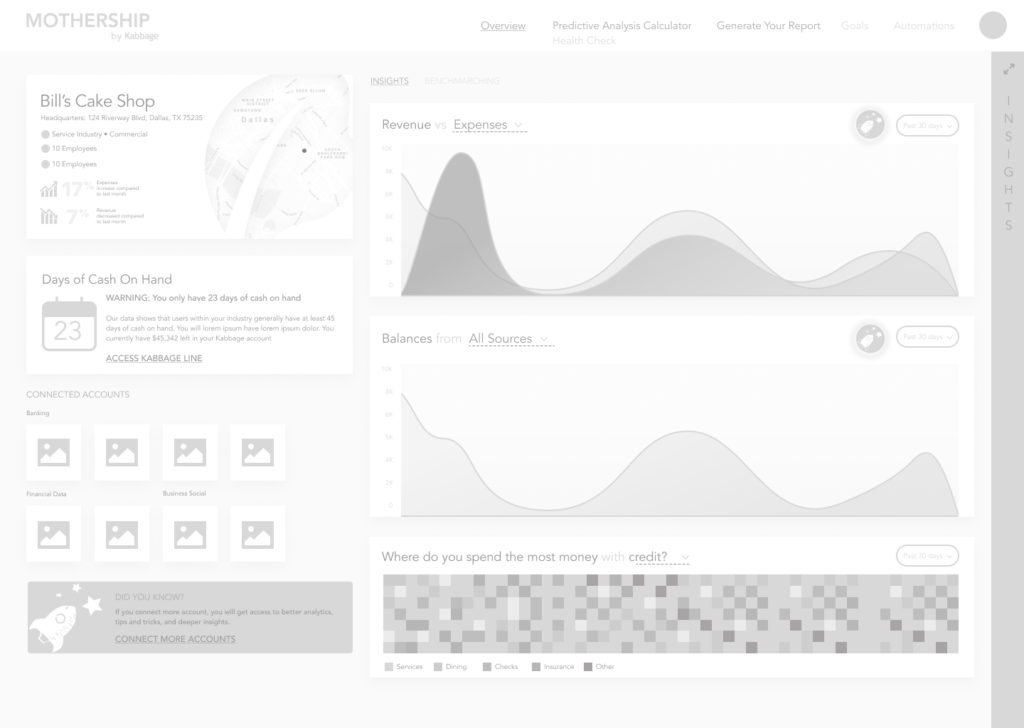

After our research,  I helped craft a product opportunities document

I helped craft a product opportunities document  sketching a vision for a potential central hub

sketching a vision for a potential central hub  .

.

Sprint Three: Design

Designing and refining features based on user needs

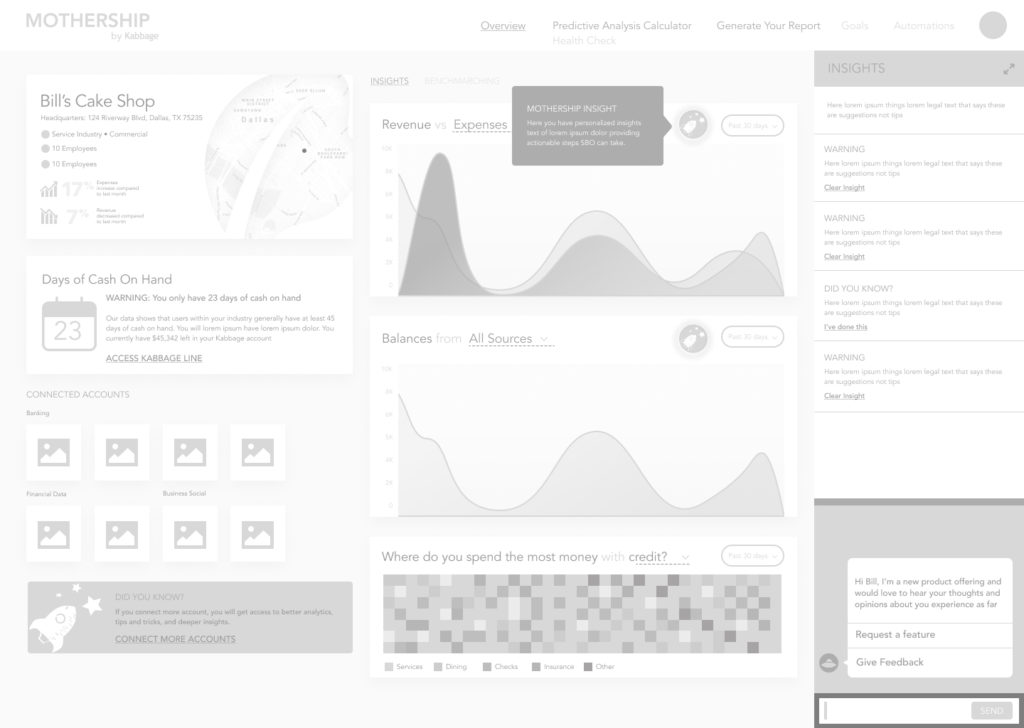

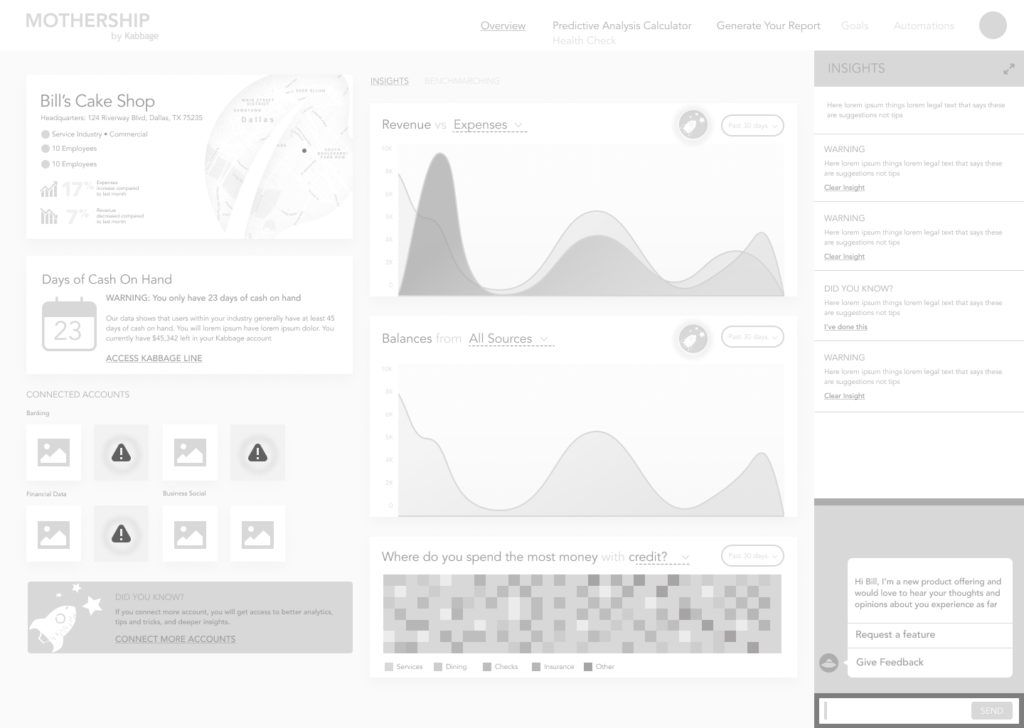

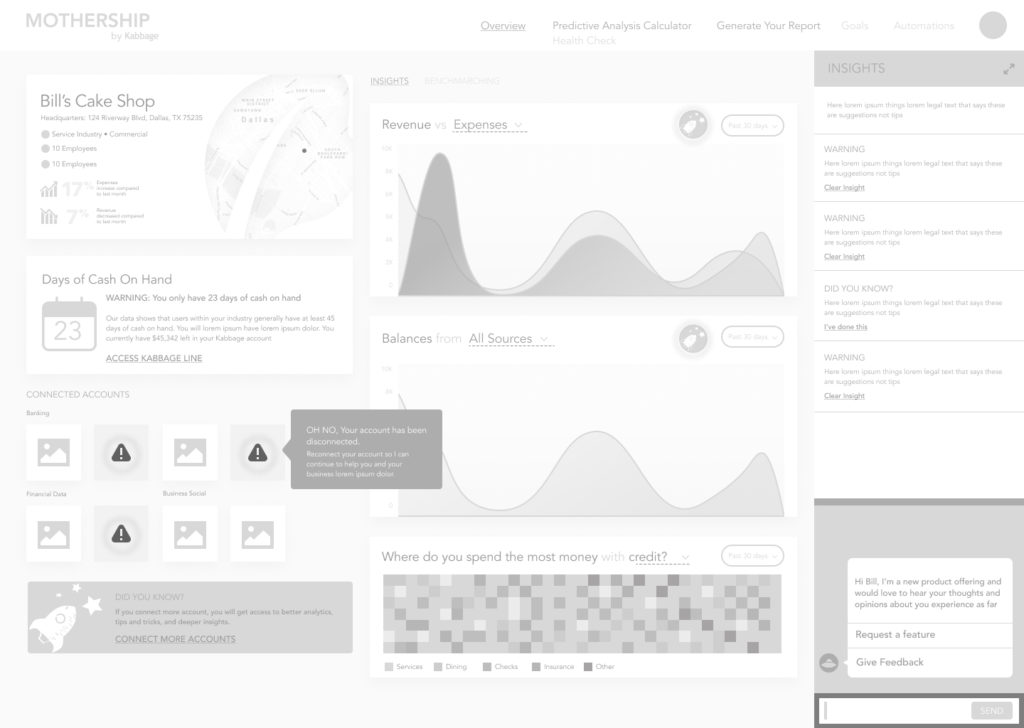

Iteration One

In the first phase of designs, we tested out multiple prototypes with a variety of users.

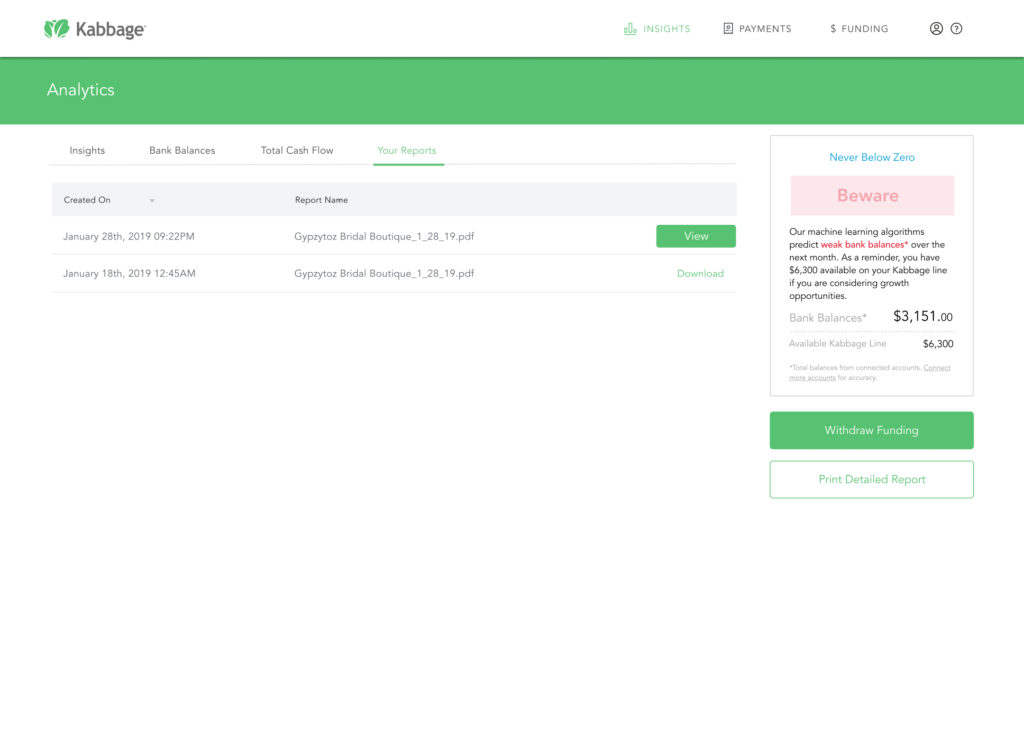

Iteration Two

We then iterated to include customer feedback, and created a coded live site for users to test.

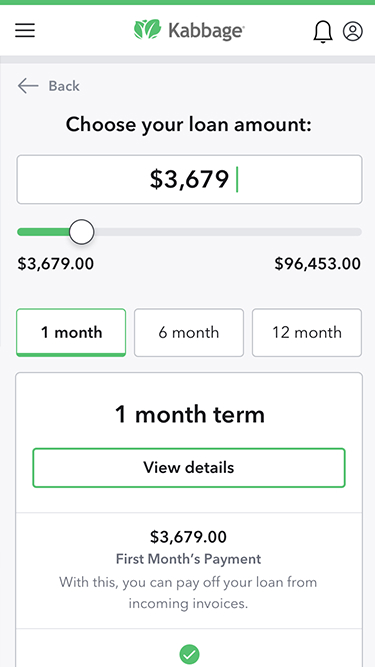

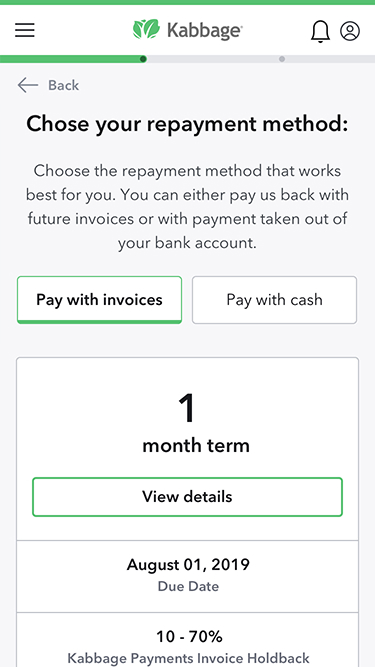

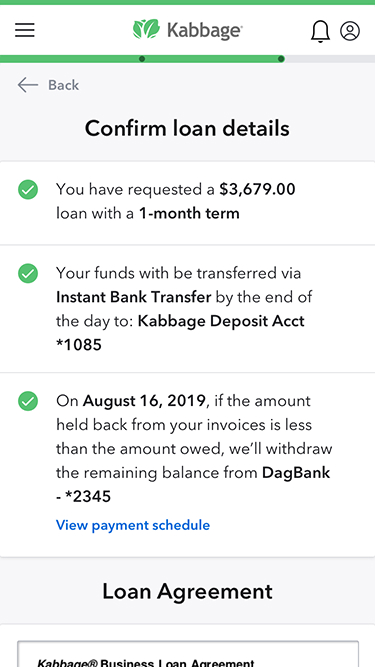

The final task was creating  an easy-to-use mobile

an easy-to-use mobile  native app experience

native app experience  .

.

MOBILE DEVELOPMENT

A focus on crafting a intuitive experience

Working with charts and graphs on mobile is a hard challenge. My major goal with the mobile experience was ensuring that users were always aware of their financial well-being with a tap of a button

The Results

17

1

“By far the best team I’ve ever worked with”

Head of Kabbage Lending

Final Thoughts

Building CFAAS was an initiative that took more than a year and it would not have been possible with the amazing support from a variety of folks on the Kabbage team.

The contributions made by our team sparked the development of three additional products for Kabbage, a pivotal advancement that ultimately paved the way for the company’s successful acquisition of $1b by American Express.